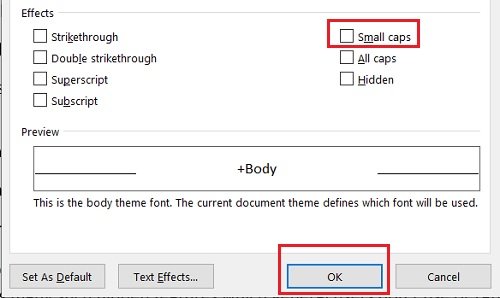

These are not traditionally part of many fonts, but they can be extremely useful.

That makes small-cap stocks riskier than so-called blue chips. Just as these stocks have more upside potential, there's also substantial downside risk, as they're less likely to be profitable and can more easily be pushed into bankruptcy. Of course, small-cap stocks don't always outperform. When the economy is rebounding, unemployment rates are quickly going down, and businesses are seeing strong earnings growth - this is a great time to invest in small-cap stocks. On average, small-caps have an advantage when the U.S. Similarly, fiscal stimuli are also beneficial for small-cap stocks, as these companies are generally more sensitive to consumer spending and market sentiment. Smaller companies also benefit from such accommodative monetary policies as low interest rates, which make it easier for them to borrow to expand or keep their businesses afloat during tough times. In fact, the Russell 2000 would go on to outperform the S&P 500 for most of the decade that followed the financial crisis. For example, during the 2020 crash, when the coronavirus pandemic hit the U.S., small-cap stocks fell further than their large-cap peers.Īdditionally, small-cap stocks are followed by fewer investors and Wall Street analysts, so they often have bigger swings on news like earnings reports. This makes them more volatile than large caps, as they are more vulnerable to recessions, market crashes, and other shocks. However, small caps are also more likely to be unprofitable. Again, it's easier for a smaller company to double its revenue, whereas mature companies tend to see slowing revenue growth. Small-cap stocks tend to have higher growth rates. If you had bought and held these stocks when they were small, you would have seen your initial investment appreciate more than 100 times. In fact, some of the biggest companies in the world once traded in the small-cap range, like Amazon and Netflix. For instance, it's considerably easier for a $1 billion company to become a $10 billion one than it is for a $100 billion company to grow to $1 trillion. The best reason to invest in small-cap stocks is their greater potential to deliver outsize returns than larger companies. Small-cap stocks have the potential to maximize returns Under the right circumstances, small caps are a good bet to outperform their larger peers. As a group, these companies are much smaller than their larger-cap counterparts and therefore have greater growth potential. While there are many good reasons to own large-cap stocks, it also behooves investors to seek out small-cap stocks - those with $300 million to $2 billion in market cap. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market.įollow most investors begin their hunt for a new stock, it starts and ends with a large-cap name valued at over $10 billion. I write about consumer goods, the big picture, and whatever else piques my interest.

0 kommentar(er)

0 kommentar(er)